6 Multiple Regression

In Chapter 5, we studied simple linear regression as a model that represents the relationship between two variables: an outcome variable or response \(y\) and an explanatory variable or regressor \(x\). Furthermore, to keep things simple, we only considered models with one explanatory \(x\) variable that was either numerical in Section 5.1 or categorical in Section 5.2.

In this chapter, we introduce multiple linear regression, the direct extension to simple linear regression when more than one explanatory variable is taken into account to explain changes in the outcome variable. As we show in the next few sections, much of the material developed for simple linear regression translates directly into multiple linear regression, but the interpretation of the associated effect of any one explanatory variable must be made taking into account the other explanatory variables included in the model.

Needed packages

If needed, read Section 1.3 for information on how to install and load R packages.

6.1 One numerical and one categorical explanatory variable

We continue using the UN member states dataset introduced in Section 5.1. Recall that we studied the relationship between the outcome variable fertility rate, \(y\), and the regressor life expectancy, \(x\).

In this section, we introduce one additional regressor to this model:

the categorical variable income group with four categories:

Low income, Lower middle income, Upper middle income, and

High income. We now want to study how fertility rate changes due to

changes in life expectancy and different income levels. To do this, we

use multiple regression. Observe

that we now have:

- A numerical outcome variable \(y\), the fertility rate in a given country or state, and

- Two explanatory variables:

- A numerical explanatory variable \(x_1\), the life expectancy.

- A categorical explanatory variable \(x_2\), the income group.

6.1.1 Exploratory data analysis

The UN member states data frame is included in the moderndive package.

To keep things simple, we select() only the subset of the variables

needed here, and save this data in a new data frame called

UN_data_ch6. Note that the variables used are different than the ones

chosen in Chapter 5. We also set the income variable

to be a factor so that its levels show up in the expected order.

UN_data_ch6 <- un_member_states_2024 |>

select(country,

life_expectancy_2022,

fertility_rate_2022,

income_group_2024)|>

na.omit()|>

rename(life_exp = life_expectancy_2022,

fert_rate = fertility_rate_2022,

income = income_group_2024)|>

mutate(income = factor(income,

levels = c("Low income", "Lower middle income",

"Upper middle income", "High income")))Recall the three common steps in an exploratory data analysis we saw in Subsection 5.1.1:

- Inspecting a sample of raw values.

- Computing summary statistics.

- Creating data visualizations.

We first look at the raw data values by either looking at UN_data_ch6

using RStudio’s spreadsheet viewer or by using the glimpse() function

from the dplyr package:

glimpse(UN_data_ch6)Rows: 182

Columns: 4

$ country <chr> "Afghanistan", "Albania", "Algeria", "Angola", "Antigua and Barbuda", "Argentina", "Armenia", "Austr…

$ life_exp <dbl> 53.6, 79.5, 78.0, 62.1, 77.8, 78.3, 76.1, 83.1, 82.3, 74.2, 76.1, 79.9, 74.7, 78.5, 74.3, 81.9, 75.8…

$ fert_rate <dbl> 4.3, 1.4, 2.7, 5.0, 1.6, 1.9, 1.6, 1.6, 1.5, 1.6, 1.4, 1.8, 1.9, 1.6, 1.5, 1.6, 2.0, 4.7, 1.4, 2.5, …

$ income <fct> Low income, Upper middle income, Lower middle income, Lower middle income, High income, Upper middle…The variable country contains all the UN member states. R reads this

variable as character, <chr>, and beyond the country identification it

will not be needed for the analysis. The variables life expectancy,

life_exp, and fertility rate, fert_rate, are numerical, and the

variable income, income, is categorical. In R, categorical variables

are called factors and the categories are factor levels.

We also display a random sample of 10 rows of the 182 rows corresponding to different countries in Table 6.1. Remember due to the random nature of the sampling, you will likely end up with a different subset of 10 rows.

UN_data_ch6 |> sample_n(size = 10)| country | life_exp | fert_rate | income |

|---|---|---|---|

| Trinidad and Tobago | 75.9 | 1.6 | High income |

| Micronesia, Federated States of | 74.4 | 2.6 | Lower middle income |

| North Macedonia | 76.8 | 1.4 | Upper middle income |

| Portugal | 81.5 | 1.4 | High income |

| Madagascar | 68.2 | 3.7 | Low income |

| Cambodia | 70.7 | 2.3 | Lower middle income |

| Dominica | 78.2 | 1.6 | Upper middle income |

| Peru | 68.9 | 2.1 | Upper middle income |

| Cyprus | 79.7 | 1.3 | High income |

| Guinea-Bissau | 63.7 | 3.8 | Low income |

Life expectancy, life_exp, is an estimate of how many years, on

average, a person in a given country is expected to live. Fertility

rate, fert_rate, is the average number of live births per woman of

childbearing age in a country. As we did in our exploratory data

analyses in Sections 5.1.1 and 5.2.1 from Chapter

5, we find summary statistics:

UN_data_ch6 |>

select(life_exp, fert_rate, income) |>

tidy_summary()| column | n | group | type | min | Q1 | mean | median | Q3 | max | sd |

|---|---|---|---|---|---|---|---|---|---|---|

| life_exp | 182 | numeric | 53.6 | 69.4 | 73.67 | 75.2 | 78.4 | 86.4 | 6.86 | |

| fert_rate | 182 | numeric | 0.9 | 1.6 | 2.49 | 2.0 | 3.2 | 6.6 | 1.16 | |

| income | 25 | Low income | factor | |||||||

| income | 52 | Lower middle income | factor | |||||||

| income | 49 | Upper middle income | factor | |||||||

| income | 56 | High income | factor |

Recall that each row in UN_data_ch6 represents a particular country or

UN member state. The tidy_summary() function shows a summary for the

numerical variables life expectancy (life_exp), fertility rate

(fert_rate), and the categorical variable income group (income).

When the variable is numerical, the tidy_summary() function provides

the total number of observations in the data frame, the five-number

summary, the mean, and the standard deviation.

For example, the first

row of our summary refers to life expectancy as life_exp. There are

182 observations for this variable, it is a numerical

variable, and the first quartile, Q1, is 69.4; this means that the

life expectancy of 25% of the UN member states is less than 69.4 years.

When a variable in the dataset is categorical, also called a factor,

the summary shows all the categories or factor levels and the number of

observations for each level. For example, income group (income) is a

factor with four levels: Low Income, Lower middle income,

Upper middle income, and High income. The summary also provides the

number of states for each factor level; observe, for example, that the

dataset has 56 UN member states that are considered High Income

states.

Furthermore, we can compute the correlation coefficient between our two

numerical variables: life_exp and fert_rate. Recall from Subsection

5.1.1 that correlation coefficients only exist between

numerical variables. We observe that they are “strongly negatively”

correlated.

UN_data_ch6 |>

get_correlation(formula = fert_rate ~ life_exp)# A tibble: 1 × 1

cor

<dbl>

1 -0.815We are ready to create data visualizations, the last of our exploratory

data analysis. Given that the outcome variable fert_rate and

explanatory variable life_exp are both numerical, we can create a

scatterplot to display their relationship, as we did in Figure

5.2. But this time, we incorporate the categorical

variable income by mapping this variable to the color aesthetic,

thereby creating a colored scatterplot.

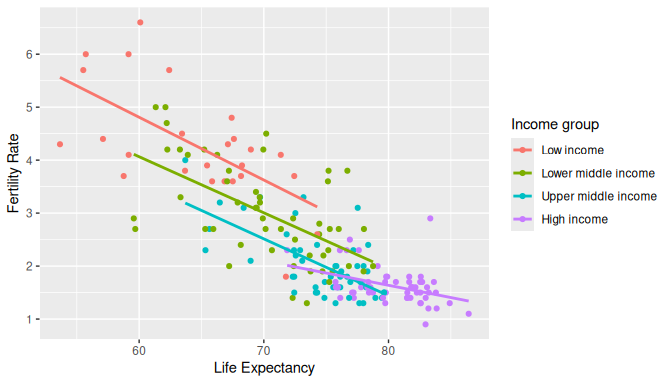

ggplot(UN_data_ch6, aes(x = life_exp, y = fert_rate, color = income)) +

geom_point() +

labs(x = "Life Expectancy", y = "Fertility Rate", color = "Income group") +

geom_smooth(method = "lm", se = FALSE)

FIGURE 6.1: Colored scatterplot of life expectancy and fertility rate.

In the resulting Figure 6.1, observe that

ggplot() assigns a default color scheme to the points and to the lines

associated with the four levels of income: Low income,

Lower middle income, Upper middle income, and High income.

Furthermore, the geom_smooth(method = "lm", se = FALSE) layer

automatically fits a different regression line for each group.

We can see some interesting trends. First, observe that we get a

different line for each income group. Second, the slopes for all the

income groups are negative. Third, the slope for the High income group

is clearly less steep than the slopes for all other three groups. So,

the changes in fertility rate due to changes in life expectancy are

dependent on the level of income of a given country. Fourth, observe

that high-income countries have, in general, high life expectancy and

low fertility rates.

6.1.2 Model with interactions

We can represent the four regression lines in Figure 6.1 as a multiple regression model with interactions.

Before we do this, however, we review a linear regression with only one categorical explanatory variable. Recall in Subsection 5.2.2 we fit a regression model for each country life expectancy as a function of the corresponding continent. We produce the corresponding analysis here, now using the fertility rate as the response variable and the income group as the categorical explanatory variable. We’ll use slightly different notation to what was done previously to make the model more general.

A linear model with a categorical explanatory variable is called a

one-factor model where factor refers to the categorical explanatory

variable and the categories are also called factor levels. We represent

the categories using indicator functions or dummy variables. In our UN

data example, The variable income has four categories or levels:

Low income, Lower middle income, Upper middle income, and

High income. The corresponding dummy variables needed are:

\[ D_1 = \left\{ \begin{array}{ll} 1 & \text{if the UN member state has low income} \phantom{asfdasfd} \\ 0 & \text{otherwise}\end{array} \right. \] \[ D_2 = \left\{ \begin{array}{ll} 1 & \text{if the UN member state has lower middle income} \\ 0 & \text{otherwise}\end{array} \right. \] \[ D_3 = \left\{ \begin{array}{ll} 1 & \text{if the UN member state has high middle income}\phantom{a} \\ 0 & \text{otherwise}\end{array} \right. \] \[ D_4 = \left\{ \begin{array}{ll} 1 & \text{if the UN member state has high income} \phantom{asfdafd}\\ 0 & \text{otherwise}\end{array} \right.\\ \]

So, for example, if a given UN member state has Low income, its dummy

variables are \(D_1 = 1\) and \(D_2 = D_3 = D_4 = 0\). Similarly, if another

UN member state has High middle income, then its dummy variables

would be \(D_1 = D_2 = D_4 = 0\) and \(D_3 = 1\). Using dummy variables, the

mathematical formulation of the linear regression for our example is:

\[\hat y = \widehat{\text{fert rate}} = b_0 + b_2 D_2 + b_3 D_3 + b_4 D_4\]

or if we want to express it in terms of the \(i\)th observation in our dataset, we can include the \(i\)th subscript:

\[\hat y_i = \widehat{\text{fert rate}} = b_0 + b_2 D_{2i} + b_3 D_{3i} + b_4 D_{4i}\]

Recall that the coefficient \(b_0\) represents the intercept and the

coefficients \(b_2\), \(b_3\), and \(b_4\) are the offsets based on the

appropriate category. The dummy variables, \(D_2\), \(D_3\), and \(D_4\), take

the values of zero or one depending on the corresponding category of any

given country. Observe also that \(D_1\) does not appear in the model. The

reason for this is entirely mathematical: if the model would contain an

intercept and all the dummy variables, the model would be

over-specified, that is, it would contain one redundant explanatory

variable. The solution is to drop one of the variables. We keep the

intercept because it provides flexibility when interpreting more

complicated models, and we drop one of the dummy variables which, by

default in R, is the first dummy variable, \(D_1\). This does not mean

that we are losing information of the first level \(D_1\). If a country is

part of the Low income level, \(D_1 = 1\), \(D_2 = D_3 = D_4 = 0\), so

most of the terms in the regression are zero and the linear regression

becomes:

\[\hat y = \widehat{\text{fert rate}} = b_0\] So the intercept

represents the average fertility rate when the country is a Low income

country. Similarly, if another country is part of the

High middle income level, then \(D_1 = D_2 = D_4 = 0\) and \(D_3 = 1\) so

the linear regression becomes:

\[\hat y = \widehat{\text{fert rate}} = b_0 + b_3\] The average

fertility rate for a High middle income country is \(b_0 + b_3\).

Observe that \(b_3\) is an offset for life expectancy between the

baseline level and the High middle income level. The same logic

applies to the model for each possible income category.

We calculate the regression coefficients using the lm() function and the

command coef() to retrieve the coefficients of the linear regression:

We present these results on a table with the mathematical notation used above:

| Coefficients | Values | |

|---|---|---|

| (Intercept) | b0 | 4.28 |

| incomeLower middle income | b2 | -1.30 |

| incomeUpper middle income | b3 | -2.25 |

| incomeHigh income | b4 | -2.65 |

The first level, Low income, is the “baseline” group. The average

fertility rate for Low income UN member states is 4.28.

Similarly, the average fertility rate for Upper middle income member

states is 4.28 + -2.25 = 2.03.

We are now ready to study the multiple linear regression model with

interactions shown in Figure 6.1. In this figure we

can identify three different effects. First, for any fixed level of life

expectancy, observe that there are four different fertility rates. They

represent the effect of the categorical explanatory variable, income.

Second, for any given regression line, the slope represents the change

in average fertility rate due to changes on life expectancy. This is the

effect of the numerical explanatory variable life_exp. Third, observe

that the slope of the line depends on the income level; as an

illustration, observe that for High income member states the slope is

less steep than for Low income member states. When the slope changes

due to changes in the explanatory variable, we call this an

interaction effect.

The mathematical formulation of the linear regression model with two explanatory variables, one numerical and one categorical, and interactions is:

\[\begin{aligned}\widehat{y} = \widehat{\text{fert rate}} = b_0 &+ b_{02}D_2 + b_{03}D_3 + b_{04}D_4 \\ &+ b_1x \\ &+ b_{12}xD_2 + b_{13}xD_3 + b_{14}xD_4\end{aligned}\]

The linear regression shows how the average life expectancy is affected

by the categorical variable, the numerical variable, and the interaction

effects. There are eight coefficients in our model and we have separated

their coefficients into three lines to highlight their different roles.

The first line shows the intercept and the effects of the categorical

explanatory variables. Recall that \(D_2\), \(D_3\), and \(D_4\) are the dummy

variables in the model and each is equal to one or zero depending on the

category of the country at hand; correspondingly, the coefficients

\(b_{02}\), \(b_{03}\), and \(b_{04}\) are the offsets with respect to the

baseline level of the intercept, \(b_0\). Recall that the first dummy

variable has been dropped and the intercept captures this effect. The

second line in the equation represents the effect of the numerical

variable, \(x\). In our example \(x\) is the value of life expectancy. The

coefficient \(b_1\) is the slope of the line and represents the change in

fertility rate due to one unit change in life expectancy. The third line

in the equation represents the interaction effects on the slopes.

Observe that they are a combination of life expectancy, \(x\), and income

level, \(D_2\), \(D_3\), and \(D_4\). What these interaction effects do is to

modify the slope for different levels of income. For a

Low income member state, the dummy variables are \(D_1 = 1\),

\(D_2 = D_3 = D_4 = 0\) and our linear regression is:

\[\begin{aligned}\widehat{y} = \widehat{\text{fert rate}} &= b_0 + b_{02}\cdot 0 + b_{03}\cdot 0 + b_{04}\cdot 0 + b_1x + b_{12}x\cdot 0 + b_{13}x\cdot 0 + b_{14}x\cdot 0\\ & = b_0 + b_1x \end{aligned}\]

Similarly, for a High income member state, the dummy variables are

\(D_1 = D_2 =D_3 = 0\), and \(D_4 = 1\). We take into account the offsets

for the intercept, \(b_{04}\), and the slope, \(b_{14}\), and the linear

regression becomes:

\[\begin{aligned}\widehat{y} = \widehat{\text{fert rate}} &= b_0 + b_{02}\cdot 0 + b_{03}\cdot 0 + b_{04}\cdot 1 + b_1 x + b_{12}x\cdot 0 + b_{13}x\cdot 0 + b_{14}x\cdot 1\\ & = b_0 + b_{04} + b_1x + b_{14}x\\ & = (b_0 + b_{04}) + (b_1 + b_{14})\cdot x\end{aligned}\]

Observe how the intercept and the slope are different for a

High income member state when compared to the baseline Low income

member state. As an illustration, we construct this multiple linear

regression for the UN member state dataset in R. We first “fit” the

model using the lm() “linear model” function and then find the

coefficients using the function coef(). In R, the formula used is

y ~ x1 + x2 + x1:x2 where x1 and x2 are the variable names in the

dataset and represent the main effects while x1:x2 is the interaction

term. For simplicity, we can also write y ~ x1 * x2 as the * sign

accounts for both, main effects and interaction effects. R would let

both x1 and x2 be either explanatory or numerical, and we need to

make sure the dataset format is appropriate for the regression we want

to run. Here is the code for our example:

# Fit regression model and get the coefficients of the model

model_int <- lm(fert_rate ~ life_exp * income, data = UN_data_ch6)

coef(model_int)| Coefficients | Values | |

|---|---|---|

| (Intercept) | b0 | 11.918 |

| incomeLower middle income | b02 | -1.504 |

| incomeUpper middle income | b03 | -1.893 |

| incomeHigh income | b04 | -6.580 |

| life_exp | b1 | -0.118 |

| incomeLower middle income:life_exp | b12 | 0.013 |

| incomeUpper middle income:life_exp | b13 | 0.011 |

| incomeHigh income:life_exp | b14 | 0.072 |

We can match the coefficients with the values computed in Table 6.2: the fitted

fertility rate \(\widehat{y} = \widehat{\text{fert rate}}\) for

Low income countries is

\[\widehat{\text{fert rate}} = b_0 + b_1\cdot x = 11.92 + (-0.12)\cdot x,\]

which is the equation of the regression line in Figure

6.1 for low income countries. The regression has an

intercept of 11.92 and a slope of -0.12. Since life

expectancy is greater than zero for all countries, the intercept has no

practical interpretation and we only need it to produce the most

appropriate line. The interpretation of the slope is: for

Low income countries, every additional year of life expectancy reduces

the average fertility rate by 0.12 units.

As discussed earlier, the intercept and slope for all the other income

groups are determined by taking into account the appropriate offsets. For

example, for High income countries \(D_4 = 1\) and all other

dummy variables are equal to zero. The regression line becomes

\[\widehat{y} = \widehat{\text{fert rate}} = b_0 + b_1x + b_{04} + b_{14}x = (b_0 + b_{04} ) + (b_1+b_{14})x \]

where \(x\) is life expectancy, life_exp. The intercept is

(Intercept) + incomeHigh income:

\[b_0 + b_{04} = 11.92 +(-6.58) = 5.34,\]

and the slope for these High income countries is

life_exp + life_exp:incomeHigh income corresponding to

\[b_1 + b_{14}= -0.12 + 0.07 = -0.05.\]

For High income countries, every additional year of life expectancy

reduces the average fertility rate by 0.05

units. The intercepts and slopes for other income levels are calculated

similarly.

Since the life expectancy for Low income countries has a steeper slope

than High income countries, one additional year of life expectancy

will decrease fertility rates more for the low-income group than for the

high-income group. This is consistent with our observation from Figure

6.1. When the associated effect of one variable

depends on the value of another variable we say that there is an

interaction effect. This is the reason why the regression slopes are

different for different income groups.

Learning check

(LC6.1) What is the goal of including an interaction term in a multiple regression model?

- A. To create more variables for analysis.

- B. To account for the effect of one explanatory variable on the response while considering the influence of another explanatory variable.

- C. To make the model more complex without any real benefit.

- D. To automatically improve the fit of the regression line.

(LC6.2) How does the inclusion of both main effects and interaction terms in a regression model affect the interpretation of individual coefficients?

- A. They represent simple marginal effects.

- B. They become meaningless.

- C. They are conditional effects, depending on the level of the interacting variables.

- D. They are interpreted in the same way as in models without interactions.

(LC6.3) Which statement about the use of dummy variables in regression models is correct?

- A. Dummy variables are used to represent numerical variables.

- B. Dummy variables are used to represent categorical variables at least two levels.

- C. Dummy variables always decrease the R-squared value.

- D. Dummy variables are unnecessary in regression models.

6.1.3 Model without interactions

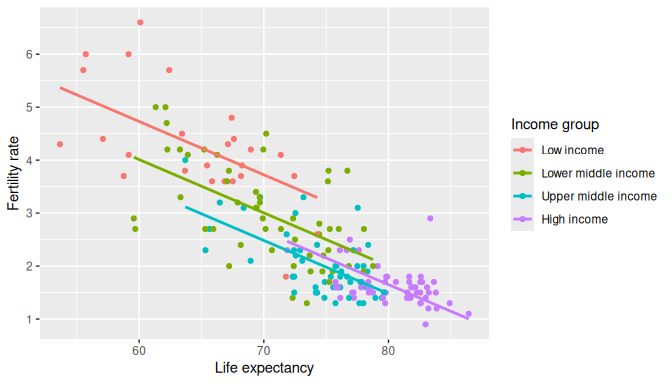

We can simplify the previous model by removing the interaction effects. The model still represents different income groups with different regression lines by allowing different intercepts but all the lines have the same slope: they are parallel as shown in Figure 6.2.

To plot parallel slopes we use the function

geom_parallel_slopes()

that is included in the moderndive package. To use this function you need

to load both the ggplot2 and moderndive packages. Observe how the

code is identical to the one used for the model with interactions in

Figure 6.1, but now the

geom_smooth(method = "lm", se = FALSE) layer is replaced with

geom_parallel_slopes(se = FALSE).

ggplot(UN_data_ch6, aes(x = life_exp, y = fert_rate, color = income)) +

geom_point() +

labs(x = "Life expectancy", y = "Fertility rate", color = "Income group") +

geom_parallel_slopes(se = FALSE)

FIGURE 6.2: Parallel slopes model of fertility rate with life expectancy and income.

The regression lines for each income group are shown in Figure 6.2. Observe that the lines are now parallel: they all have the same negative slope. The interpretation of this result is that the change in fertility rate due to changes in life expectancy in a given country are the same regardless the income group of this country.

On the other hand, any two regression lines in Figure

6.2 have different intercepts representing the

income group; in particular, observe that for any fixed level of life

expectancy the fertility rate is greater for Low income and

Lower middle income countries than for Upper middle income and

High income countries.

The mathematical formulation of the linear regression model with two explanatory variables, one numerical and one categorical, and without interactions is:

\[\widehat{y} = b_0 + b_{02}D_2 + b_{03}D_3 + b_{04}D_4+ b_1x.\] Observe

that the dummy variables only affect the intercept now, and the slope is

fully described by \(b_1\) for any income group. In the UN data example, a

High income country, with \(D_4 = 1\) and the other dummy variables

equal to zero, will be represented by

\[\widehat{y} = (b_0 + b_{04})+ b_1x.\]

To find the coefficients for this regression in R, the formula used is

y ~ x1 + x2 where x1 and x2 are the variable names in the dataset

and represent the main effects. Observe that the term x1:x2

representing the interaction is no longer included. R would let both

x1 and x2 to be either explanatory or numerical; therefore, we

should always check that the variable format is appropriate for the

regression we want to run. Here is the code for the UN data example:

# Fit regression model:

model_no_int <- lm(fert_rate ~ life_exp + income, data = UN_data_ch6)

# Get the coefficients of the model

coef(model_no_int)| Coefficients | Values | |

|---|---|---|

| (Intercept) | b0 | 10.768 |

| incomeLower middle income | b02 | -0.719 |

| incomeUpper middle income | b03 | -1.239 |

| incomeHigh income | b04 | -1.067 |

| life_exp | b1 | -0.101 |

In this model without interactions presented in Table

6.3, the slope is the same for all the

regression lines, \(b_1 = -0.101\). Assuming that this model is

correct, for any UN member state, every additional year of life

expectancy reduces the average fertility rate by 0.101

units, regardless of the income level of the member state. The intercept

of the regression line for Low income member states is

10.768 while for High income member states is

\(10.768 + (-1.067) = 9.701\).

The intercepts for other income levels can be determined similarly. We

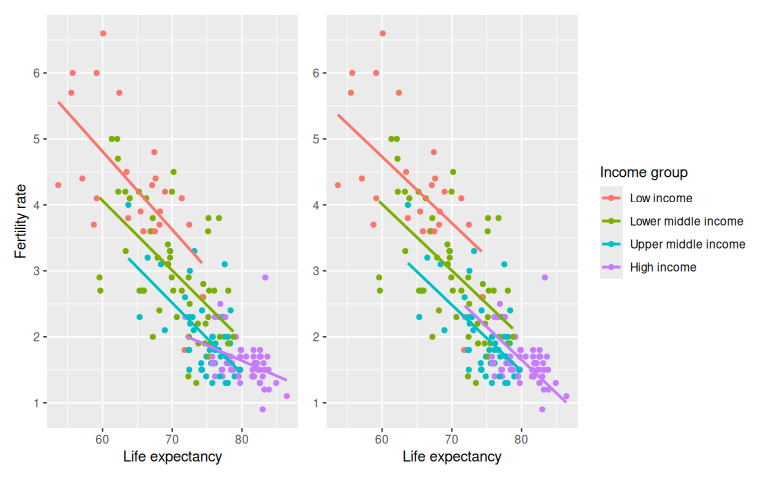

compare the visualizations for both models side-by-side in Figure

6.3.

FIGURE 6.3: Comparison of interaction and parallel slopes models.

Which one is the preferred model? Looking at the scatterplot and the clusters of points in Figure 6.3, it does appear that lines with different slopes capture better the behavior of different groups of points. The lines do not appear to be parallel and the interaction model seems more appropriate.

Learning check

(LC6.4) How should a model with one categorical regressor and one numerical regressor, but no interactions, be interpreted?

- A. The slope of the model for each category is different.

- B. The slope of the model for each category is the same.

- C. There is no relationship between the categorical regressor and the response.

- D. There is no relationship between the numerical regressor and the response.

6.1.4 Observed responses, fitted values, and residuals

In this subsection, we work with the regression model with interactions.

The coefficients for this model were found earlier, saved in

model_int, and are displayed in Table 6.4:

| Coefficients | Values | |

|---|---|---|

| (Intercept) | b0 | 11.918 |

| incomeLower middle income | b02 | -1.504 |

| incomeUpper middle income | b03 | -1.893 |

| incomeHigh income | b04 | -6.580 |

| life_exp | b1 | -0.118 |

| incomeLower middle income:life_exp | b12 | 0.013 |

| incomeUpper middle income:life_exp | b13 | 0.011 |

| incomeHigh income:life_exp | b14 | 0.072 |

We can use these coefficients to find the fitted values and residuals for any given observation. As an illustration, we chose two observations from the UN member states dataset, provided the values for the explanatory variables and response, as well as the fitted values and residuals:

| ID | fert_rate | income | life_exp | fert_rate_hat | residual |

|---|---|---|---|---|---|

| 1 | 1.3 | High income | 79.7 | 1.65 | -0.35 |

| 2 | 5.7 | Low income | 62.4 | 4.52 | 1.18 |

The first observation is a High income country with a life expectancy

of 79.74 years and an observed fertility rate equal to

1.3. The second observation is a Low income country

with a life expectancy of 62.41 years and an observed

fertility rate equal to 5.7 The fitted value, \(\hat y\),

called fert_rate_hat in the table, is the estimated value of the

response determined by the regression line. This value is computed by

using the values of the explanatory variables and the coefficients of

the linear regression. In addition, recall the difference between the

observed response value and the fitted value, \(y - \hat y\), is called

the residual.

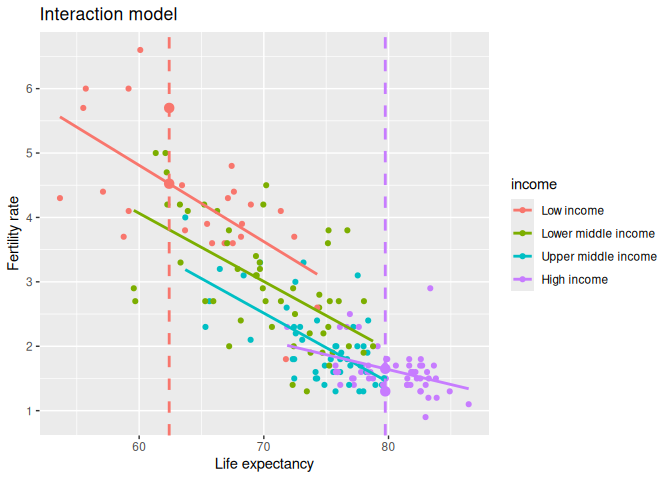

We illustrate this in Figure 6.4. The vertical line

on the left represents the life expectancy value for the Low income

country. The y-value for the large dot on the regression line that

intersects the vertical line is the fitted value for fertility rate,

\(\widehat y\), and the y-value for the large dot above the line is the

observed fertility rate, \(y\). The difference between these values,

\(y - \widehat y\), is called the residual and in this case is positive.

Similarly, the vertical line on the right represents the life expectancy

value for the High income country, the y-value for the large dot on

the regression line is the fitted fertility rate. The observed y-value

for fertility rate is below the regression line making the residual

negative.

FIGURE 6.4: Fitted values for two new countries.

We can generalize the study of fitted values and residuals for all the

countries in the UN_data_ch6 dataset, as shown in Table

6.5.

regression_points <- get_regression_points(model_int)

regression_points| ID | fert_rate | income | life_exp | fert_rate_hat | residual |

|---|---|---|---|---|---|

| 1 | 4.3 | Low income | 53.6 | 5.56 | -1.262 |

| 2 | 1.4 | Upper middle income | 79.5 | 1.50 | -0.098 |

| 3 | 2.7 | Lower middle income | 78.0 | 2.16 | 0.544 |

| 4 | 5.0 | Lower middle income | 62.1 | 3.84 | 1.159 |

| 5 | 1.6 | High income | 77.8 | 1.74 | -0.139 |

| 6 | 1.9 | Upper middle income | 78.3 | 1.62 | 0.278 |

| 7 | 1.6 | Upper middle income | 76.1 | 1.86 | -0.256 |

| 8 | 1.6 | High income | 83.1 | 1.50 | 0.105 |

| 9 | 1.5 | High income | 82.3 | 1.53 | -0.033 |

| 10 | 1.6 | Upper middle income | 74.2 | 2.07 | -0.469 |

Learning check

(LC6.5) Compute the observed response values, fitted values, and residuals for the model without interactions.

(LC6.6) What is the main benefit of visualizing the fitted values and residuals of a multiple regression model?

- A. To find errors in the dataset.

- B. To check the assumptions of the regression model, such as linearity and homoscedasticity.

- C. To always improve the model’s accuracy.

- D. To increase the complexity of the model.

6.2 Two numerical explanatory variables

We now consider regression models with two numerical explanatory

variables. To illustrate this situation we explore the ISLR2 R

package for the first time in this book using

its Credit dataset. This dataset contains

simulated information for 400 customers. For the regression model we use the

credit card balance (Balance) as the response variable; and the credit limit

(Limit), and the income (Income) as the numerical explanatory

variables.

6.2.1 Exploratory data analysis

We load the Credit data

frame and to ensure the type of

behavior we have become accustomed to in using the tidyverse, we also

convert this data frame to be a tibble using as_tibble(). We construct a new

data frame credit_ch6 with only the variables needed.

We do this by using the select() verb as we did in Subsection 3.8.1

and, in addition, we save the selecting variables with different names:

Balance becomes debt, Limit becomes credit_limit, and Income

becomes income:

library(ISLR2)

credit_ch6 <- Credit |> as_tibble() |>

select(debt = Balance, credit_limit = Limit,

income = Income, credit_rating = Rating, age = Age)You can observe the effect of our use of select() by looking at the

raw values either in RStudio’s spreadsheet viewer or by using

glimpse().

glimpse(credit_ch6)Rows: 400

Columns: 5

$ debt <dbl> 333, 903, 580, 964, 331, 1151, 203, 872, 279, 1350, 1407, 0, 204, 1081, 148, 0, 0, 368, 891, 104…

$ credit_limit <dbl> 3606, 6645, 7075, 9504, 4897, 8047, 3388, 7114, 3300, 6819, 8117, 1311, 5308, 6922, 3291, 2525, …

$ income <dbl> 14.9, 106.0, 104.6, 148.9, 55.9, 80.2, 21.0, 71.4, 15.1, 71.1, 63.1, 15.0, 80.6, 43.7, 19.1, 20.…

$ credit_rating <dbl> 283, 483, 514, 681, 357, 569, 259, 512, 266, 491, 589, 138, 394, 511, 269, 200, 286, 339, 448, 4…

$ age <dbl> 34, 82, 71, 36, 68, 77, 37, 87, 66, 41, 30, 64, 57, 49, 75, 57, 73, 69, 28, 44, 63, 72, 61, 48, …Furthermore, we present a random sample of five out of the 400 credit card holders in Table 6.6. As observed before, each time you run this code, a different subset of five rows is given.

credit_ch6 |> sample_n(size = 5)| debt | credit_limit | income | credit_rating | age |

|---|---|---|---|---|

| 0 | 1402 | 27.2 | 128 | 67 |

| 1081 | 6922 | 43.7 | 511 | 49 |

| 1237 | 7499 | 58.0 | 560 | 67 |

| 379 | 4742 | 57.1 | 372 | 79 |

| 1151 | 8047 | 80.2 | 569 | 77 |

Note that income is in thousands of dollars while debt and credit limit

are in dollars. We can also compute summary statistics using the

tidy_summary() function. We only select() the columns of interest

for our model as shown in Table 6.7:

credit_ch6 |> select(debt, credit_limit, income) |> tidy_summary()| column | n | group | type | min | Q1 | mean | median | Q3 | max | sd |

|---|---|---|---|---|---|---|---|---|---|---|

| debt | 400 | numeric | 0.0 | 68.8 | 520.0 | 459.5 | 863.0 | 1999 | 459.8 | |

| credit_limit | 400 | numeric | 855.0 | 3088.0 | 4735.6 | 4622.5 | 5872.8 | 13913 | 2308.2 | |

| income | 400 | numeric | 10.4 | 21.0 | 45.2 | 33.1 | 57.5 | 187 | 35.2 |

The mean and median credit card debt are $520.0 and $459.5,

respectively. The first quartile for debt is 68.8; this means that 25%

of card holders had debts of $68.80 or less. Correspondingly, the mean

and median credit card limit, credit_limit, are around $4,736 and

$4,622, respectively. Note also that the third quartile of income is

57.5; so 75% of card holders had incomes below $57,500.

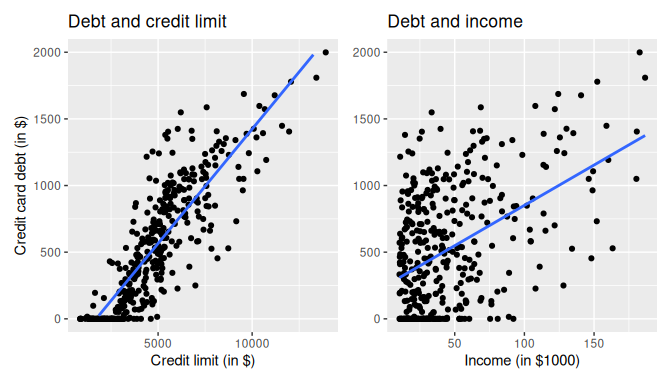

We visualize the relationship of the response variable with each of the two explanatory variables using this R code. These plots are shown in Figure 6.5.

ggplot(credit_ch6, aes(x = credit_limit, y = debt)) +

geom_point() +

labs(x = "Credit limit (in $)", y = "Credit card debt (in $)",

title = "Debt and credit limit") +

geom_smooth(method = "lm", se = FALSE)

ggplot(credit_ch6, aes(x = income, y = debt)) +

geom_point() +

labs(x = "Income (in $1000)", y = "Credit card debt (in $)",

title = "Debt and income") +

geom_smooth(method = "lm", se = FALSE)

FIGURE 6.5: Relationship between credit card debt and credit limit/income.

The left plot in Figure 6.5 shows a positive and linear association between credit limit and credit card debt: as credit limit increases so does credit card debt. Observe also that many customers have no credit card debt and there is a cluster of points at the credit card debt value of zero. The right plot in Figure 6.5 shows also positive and somewhat linear association between income and credit card debt, but this association seems weaker and actually appears positive only for incomes larger than $50,000. For lower income values it is not clear there is any association at all.

Since variables debt, credit_limit, and income are numerical, and

more importantly, the associations between the response and explanatory

variables appear to be linear or close to linear, we can also calculate the

correlation coefficient between any two of these variables. Recall that

the correlation coefficient is appropriate if the association between

the variables is linear. One way to do this is using the

get_correlation() command as seen in Subsection 5.1.1, once

for each explanatory variable with the response debt:

credit_ch6 |> get_correlation(debt ~ credit_limit)

credit_ch6 |> get_correlation(debt ~ income)Alternatively, using the select() verb and command cor() we can

find all correlations simultaneously by returning a correlation

matrix as shown in Table 6.8.

This matrix shows the correlation

coefficient for any pair of variables in the appropriate row/column

combination.

| debt | credit_limit | income | |

|---|---|---|---|

| debt | 1.000 | 0.862 | 0.464 |

| credit_limit | 0.862 | 1.000 | 0.792 |

| income | 0.464 | 0.792 | 1.000 |

Let’s look at some findings presented in the correlation matrix:

- The diagonal values are all 1 because, based on the definition of the correlation coefficient, the correlation of a variable with itself is always 1.

- The correlation between

debtandcredit_limitis 0.862. This indicates a strong and positive linear relationship: the greater the credit limit is, the larger is the credit card debt, on average. - The correlation between

debtandincomeis 0.464. The linear relationship is positive albeit somewhat weak. In other words, higher income is only weakly associated with higher debt. - Observe also that the correlation coefficient between the two

explanatory variables,

credit_limitandincome, is 0.792.

A useful property of the correlation

coefficient is that it is invariant to

linear transformations; this means that the correlation between two

variables, \(x\) and \(y\), will be the same as the correlation between

\((a\cdot x + b)\) and \(y\) for any constants \(a\) and \(b\). To illustrate

this, observe that the correlation coefficient between income in

thousands of dollars and credit card debt was 0.464. If we now find

the correlation income in dollars, by multiplying income by 1000,

and credit card debt we get:

credit_ch6 |> get_correlation(debt ~ 1000 * income)# A tibble: 1 × 1

cor

<dbl>

1 0.464The correlation is exactly the same.

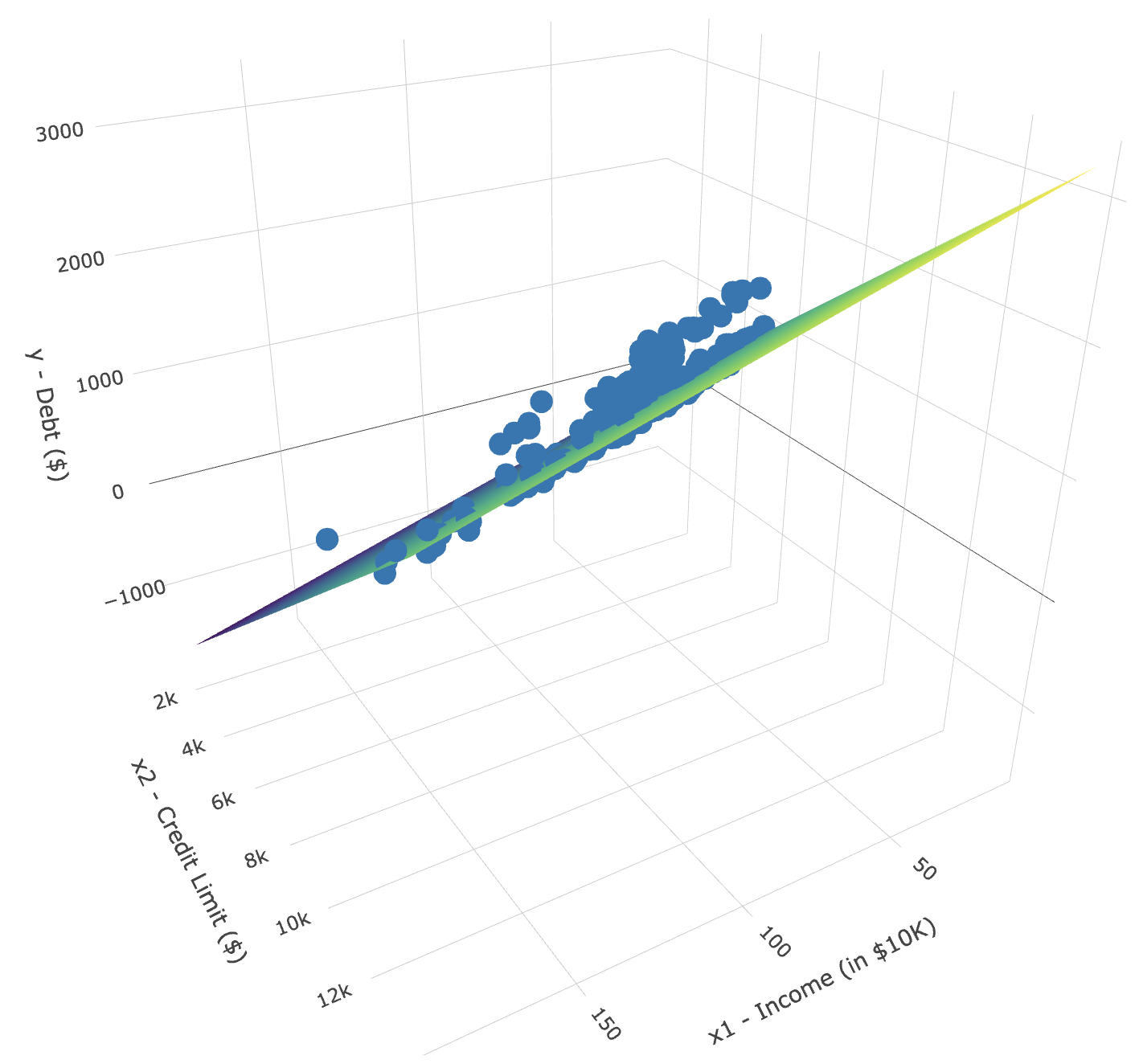

We return to our exploratory data analysis of the multiple regression.

The plots in Figure 6.5 correspond to the

response and each of the explanatory variables separately. In

Figure 6.6 we show a 3-dimensional (3D)

scatterplot representing the joint relationship of all three variables

simultaneously. Each of the 400 observations in the

credit_ch6 data frame are marked with a

blue point where

- The response variable \(y\),

debt, is on the vertical axis. - The regressors \(x_1\),

income, and \(x_2\),credit_limit, are on the two axes that form the bottom plane.

FIGURE 6.6: 3D scatterplot and regression plane.

In addition, Figure 6.6 includes a regression plane. Recall from Subsection 5.3.2 that the linear regression with one numerical explanatory variable selects the “best-fitting” line: the line that minimizes the sum of squared residuals. When linear regression is performed with two numerical explanatory variables, the solution is a “best-fitting” plane: the plane that minimizes the sum of squared residuals. Visit this website to open an interactive version of this plot in your browser.

Learning check

(LC6.7) Conduct a new

exploratory data analysis with the same outcome variable \(y\) debt but

with credit_rating and age as the new explanatory variables \(x_1\)

and \(x_2\). What can you say about the relationship between a credit card

holder’s debt and their credit rating and age?

6.2.2 Multiple regression with two numerical regressors

As shown in Figure 6.6, the linear regression with

two numerical regressors produces the “best-fitting” plane. We start

with a model with no interactions for the two numerical explanatory

variables income and credit_limit. In R we consider a model fit with

a formula of the form y ~ x1 + x2. We retrieve the regression

coefficients using the lm() function and the command coef() to

get the coefficients of the linear regression. The regression

coefficients are shown in what follows.

We present these results in a table with the mathematical notation used above:

| Coefficients | Values | |

|---|---|---|

| (Intercept) | b0 | -385.179 |

| credit_limit | b1 | 0.264 |

| income | b2 | -7.663 |

- We determine the linear regression coefficients using

lm(y ~ x1 + x2, data)wherex1andx2are the two numerical explanatory variables used. - We extract the coefficients from the output using the

coef()command.

Let’s interpret the coefficients. The intercept value is

-$385.179. If the range of values that the regressors could take

include a credit_limit of $0 and an income of $0, the intercept

would represent the average credit card debt for an individual with

those levels of credit_limit and income. This is not the case in our

data and the intercept has no practical interpretation; it is mainly

used to determine where the plane should cut the \(y\)-intercept to

produce the smallest sum of squared residuals.

Each slope in a multiple linear regression is considered a partial slope

and represents the marginal or additional contribution of a regressor

when it is added to a model that already contains other regressors. This

partial slope is typically different than the slope we may find in a

simple linear regression for the same regressor. The reason is that,

typically, regressors are correlated, so when one regressor is part of a

model, indirectly it’s also explaining part of the other regressor. When

the second regressor is added to the model, it helps explain only

changes in the response that were not already accounted for by the first

regressor. For example, the slope for credit_limit is $0.264. Keeping

income fixed to some value, for an additional increase of credit limit

by one dollar the credit debt increases, on average, by $0.264.

Similarly, the slope of income is -$7.663. Keeping credit_limit

fixed to some level, for a one unit increase of income ($1000 in

actual income), there is an associated decrease of $7.66 in credit card

debt, on average.

Putting these results together, the equation of the regression plane that gives us fitted values \(\widehat{y}\) = \(\widehat{\text{debt}}\) is:

\[ \begin{aligned} \widehat{y} = \widehat{\text{debt}} &= b_0 + b_1 \cdot x_1 + b_2 \cdot x_2\\ &= -385.179 + 0.263 \cdot x_1 - 7.663 \cdot x_2 \end{aligned} \] where \(x_1\) represents credit limit and \(x_2\) income.

To illustrate the role of partial slopes further, observe that the right

plot in Figure 6.5 shows the relationship between

debt and income in isolation, a positive relationship, so the

slope of income is positive. We can determine the value of this slope by

constructing a simple linear regression using income as the only

regressor:

# Fit regression model and get the coefficients of the model

simple_model <- lm(debt ~ income, data = credit_ch6)

coef(simple_model)| Coefficients | Values | |

|---|---|---|

| (Intercept) | b0’ | 246.51 |

| income | b2’ | 6.05 |

The regression line is given by the following with the coefficients denoted using the prime (\('\)) designation since they are different values than what we saw previously

\[

\begin{aligned}

\widehat{y} = \widehat{\text{debt}} &= b_0' + b_2' \cdot x_2 = 246.515 + 6.048 \cdot x_2

\end{aligned}

\]

where \(x_2\) is income. By contrast, when credit_limit and

income are considered jointly to explain changes in debt, the

equation for the multiple linear regression was:

\[ \begin{aligned} \widehat{y} = \widehat{\text{debt}} &= b_0 + b_1 \cdot x_1 + b_2 \cdot x_2\\ &= -385.179 + 0.263 \cdot x_1 - 7.663 \cdot x_2 \end{aligned} \]

So the slope for income in a simple linear regression is 6.048, and

the slope for income in a multiple linear regression is \(-7.663\). As

surprising as these results may appear at first, they are perfectly

valid and consistent as the slope of a simple linear regression has a

different role than the partial slope of a multiple linear regression.

The latter is the additional effect of income on debt when

credit_limit has already been taken into account.

Learning check

(LC6.8) Fit a new simple

linear regression using

lm(debt ~ credit_rating + age, data = credit_ch6) where

credit_rating and age are the new numerical explanatory variables

\(x_1\) and \(x_2\). Get information about the “best-fitting” regression

plane from the regression table by finding the coefficient of the model.

How do the regression results match up with the results from

your previous exploratory data analysis?

(LC6.9) Which of the following statements best describes the interpretation of a regression coefficient in a multiple regression model?

- A. It is the additional effect of a regressor on the response when other regressors have already been taken into account.

- B. It is the average response variable value when all explanatory variables are zero.

- C. It is always positive if the correlation is strong.

- D. It cannot be interpreted if there are more than two explanatory variables.

(LC6.10) What is a characteristic of the “best-fitting” plane in a multiple regression model with two numerical explanatory variables?

- A. It represents the line of best fit for each explanatory variable separately.

- B. It minimizes the product of residuals.

- C. It minimizes the sum of squared residuals for all combinations of regressors.

- D. It shows the exact predictions for every data point.

(LC6.11) What does the intercept represent in a multiple regression model with two explanatory variables?

- A. The effect of one explanatory variable, keeping the other constant.

- B. The change in the response variable per unit change in the explanatory variable.

- C. The correlation between the two explanatory variables.

- D. The expected value of the response variable when all regressors are zero.

(LC6.12) What does the term “partial slope” refer to in a multiple regression model?

- A. The additional effect of a regressor on the response variable, when all the other regressors have been taken into account.

- B. The total slope of all variables combined.

- C. The slope when all variables are zero.

- D. The average of all slopes in the model.

6.2.3 Observed/fitted values and residuals

As shown in Subsection 6.1.4 for the UN member states example, we find the fitted values and residuals for our credit card debt regression model. The fitted values for the credit card debt (\(\widehat{\text{debt}}\)) are computed using the equation for the regression plane:

\[

\begin{aligned}

\widehat{y} = \widehat{\text{debt}} &= -385.179 + 0.263 \cdot x_1 - 7.663 \cdot x_2

\end{aligned}

\] where \(x_1\) is credit_limit and \(x_2\) is income. The residuals

are the difference between the observed credit card debt and the fitted

credit card debt, \(y - \widehat y\), for each observation in the data

set. In R, we find the fitted values, debt_hat, and residuals,

residual, using the get_regression_points() function. In Table

6.9 we present the first 10 rows of output.

Remember that the coordinates of each of the points in our 3D

scatterplot in Figure 6.6 can be found in the

income, credit_limit, and debt columns.

get_regression_points(debt_model)| ID | debt | credit_limit | income | debt_hat | residual |

|---|---|---|---|---|---|

| 1 | 333 | 3606 | 14.9 | 454 | -120.8 |

| 2 | 903 | 6645 | 106.0 | 559 | 344.3 |

| 3 | 580 | 7075 | 104.6 | 683 | -103.4 |

| 4 | 964 | 9504 | 148.9 | 986 | -21.7 |

| 5 | 331 | 4897 | 55.9 | 481 | -150.0 |

| 6 | 1151 | 8047 | 80.2 | 1127 | 23.6 |

| 7 | 203 | 3388 | 21.0 | 349 | -146.4 |

| 8 | 872 | 7114 | 71.4 | 948 | -76.0 |

| 9 | 279 | 3300 | 15.1 | 371 | -92.2 |

| 10 | 1350 | 6819 | 71.1 | 873 | 477.3 |

6.3 Conclusion

6.3.1 Additional resources

An R script file of all R code used in this chapter is available here.

6.3.2 What’s to come?

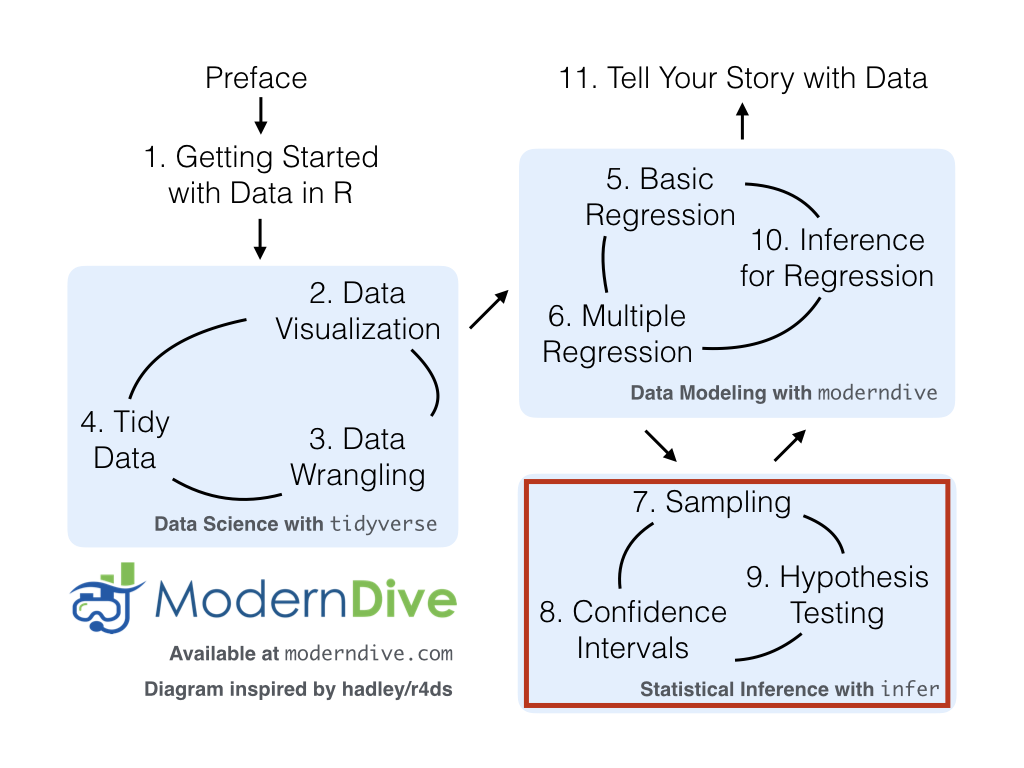

This chapter concludes the “Statistical/Data Modeling with moderndive”

portion of this book. We are ready to proceed to Part III: “Statistical

Inference with infer.” Statistical inference is the science of

inferring about some unknown quantity using sampling. So far, we have

only studied the regression coefficients and their interpretation. In

later chapters we learn how we can use information from a

sample to make inferences about the entire population.

Once we have covered Chapters 7 on sampling, 8 on confidence intervals, and 9 on hypothesis testing, we revisit the regression models in Chapter 10 on inference for regression. This will complete the topics in this book, as shown in Figure 6.7!

Also in Chapter 10, we revisit the

concept of residuals \(y - \widehat{y}\) and discuss their importance when

interpreting the results of a regression model. We perform what is known

as a residual analysis of the residual variable of all

get_regression_points() outputs. Residual analyses enable us to verify

what are known as the conditions for inference for regression.

FIGURE 6.7: ModernDive flowchart – on to Part III!